Pound up as UK races to get a new PM

The pound is higher by 0.5% vs the USD at the time of writing late on Sunday night, after Boris Johnson bowed out of the race to become the next prime minister. This leaves two candidates: Rishi Sunak and Penny Mordaunt in the running. Sunak is the clear leader, with more than 150 MPs backing him, however, if Penny Mordaunt can get 100 MPs to back her campaign, i.e., if she can persuade some Johnson supporters to back her, then technically she could breach reach the critical level needed to meet Sunak in a run-off decided by a digital vote of Conservative Party members. It looks like the market is not too concerned by either of these centrist candidates, hence the rise in the pound at the start of the trading week. We believe that the market is right. If Mordaunt does manage to breach the 100 threshold of MP support, then she faces an ethical dilemma: is it appropriate to take this contest to Tory Party members, who did such a terrible job voting in Liz Truss? If the members were to choose her over Sunak, although he has the clear backing from the majority of Tory MPs, then it could unleash more political ill will in the UK and a hastening of a general election and a tough race against the Labour party. Since financial markets are essentially dictating UK economic policy right now, and they are stable with the economic policies of Rishi Sunak, then the less volatile outcome from this race would the announcement that Sunak will be PM by Monday afternoon.

What next for GBP?

With the position of Prime Minister filled, again, the question is how will UK asset prices react over the coming weeks as we lead up to the end of the year? We think that the pound could receive a boost if Sunak is crowned winner of this race on Monday. Right now, GBP/USD has already breached the critical $1.12 resistance level, where cable was trading before the woeful Truss/ Kwarteng budget on 23/09. Above there, $1.1420 is the short-term resistance level that will need to be reached if traders are happy to keep pushing cable above the $1.15 level and potentially back to $1.20 by year end. Sunak is a safe pair of hands, the markets like him and with him in power it makes it less likely that there will be another bond market rout. The bond market is still sensitive to UK politics: on Friday, UK government bond yields jumped by 15 basis points for 10-year Gilts as the markets took fright at the prospect of another Johnson government. If there is no deviation from the strict fiscal discipline imposed by Jeremy Hunt last Monday, then we think that UK bond yields across the curve should be in retreat at the start of this week, whoever is the next leader of the United Kingdom.

Why GBP/USD upside could be limited until we know who PM is

We can safely assume that the markets would prefer if Hunt stayed on as Chancellor under a Sunak government, Afterall, he has stabilised the ship since taking on the role at the start of October. There is also the important matter of the latest Budget and OBR forecasts that are due to be presented to Parliament and the public on 31st October. There can be no delay to this, otherwise the markets may start to increase the risk premium on UK asset prices once again. We doubt that Sunak would be so stupid as to delay this important announcement, however, it’s difficult to know what a PM Mordaunt might do, if she does defy the odds and make it to number 10. Thus, until we know that the UK has a stable, centre-right government then we could see some hesitation in GBP/USD around the $1.1420 key resistance level that we mention above.

What to expect after the political drama?

Overall, once the UK’s sorry political saga is all behind us, the focus for financial markets and UK asset prices is likely to shift to three things: 1, the growth outlook, which is expected to be weak as the UK faces a period of fiscal austerity at the same time as the economy is heading into a recession, 2, what central banks will do next and 3, the global economic outlook. Points two and three are worth watching closely, as they are aligned. At the latter part of last week both a member of the Bank of England and a member of the Federal Reserve, tried to reassure markets that their central banks would not tighten rates by as much as expected. Since central banks have been at pains to point out that they would do whatever it takes to bring down inflation in recent months, this seems like a strange time to make such a policy shift when inflation is still surging. In the UK, headline inflation topped 10% last month, and in both countries core inflation is also rising, the US’s core rate of inflation is 6.6%, slightly outpacing the UK’s 6.5% annual rate.

Are central banks turning dovish?

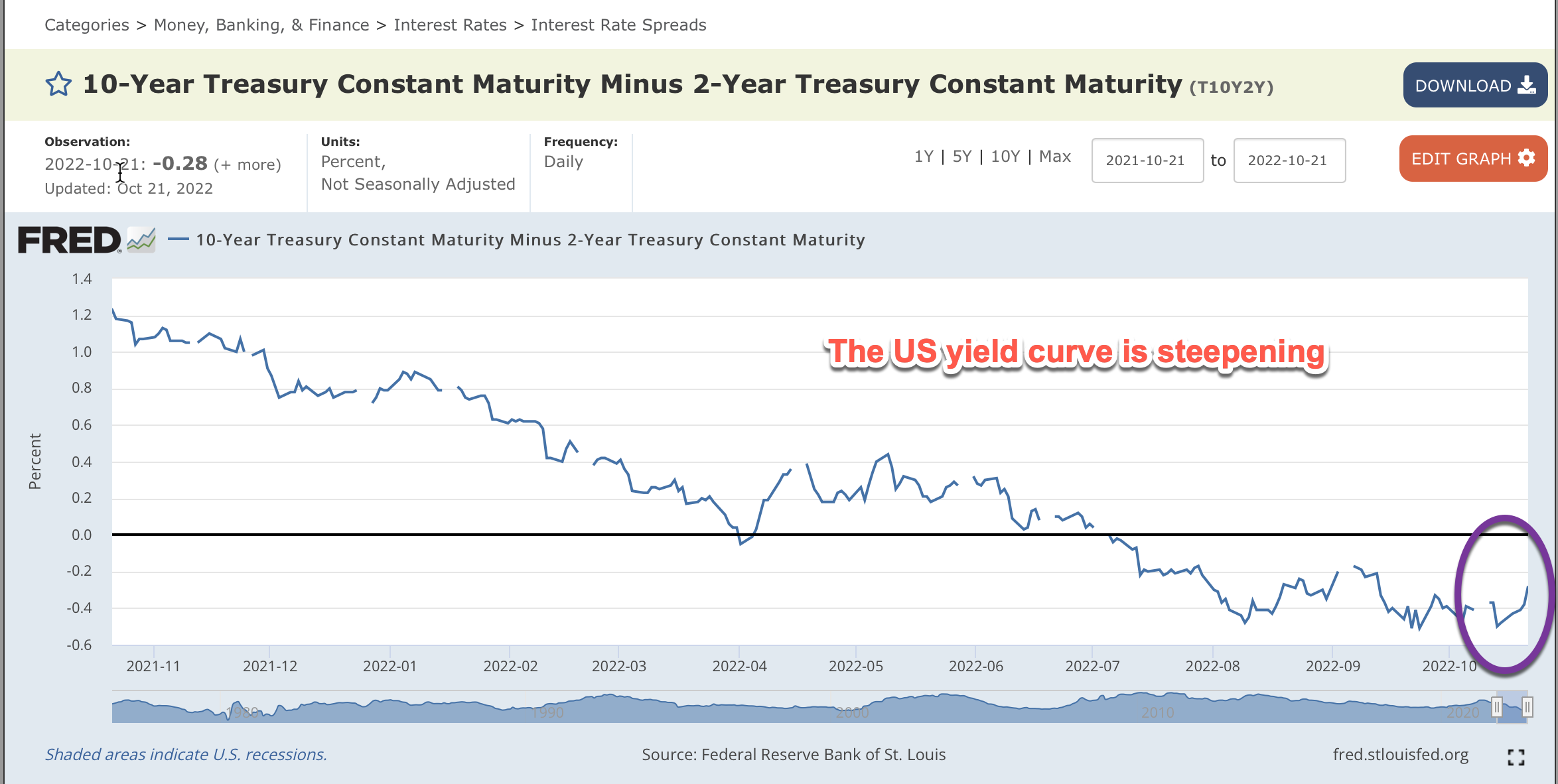

The question now is, why are central banks saying this when inflation is still rising? Arguably, because they predict a deep global recession that will push up unemployment and if they keep hiking rates at this aggressive pace then it could lead to a policy mistake: an even deeper recession and unacceptable levels of unemployment. However, with core rates of inflation this high, it means that inflation becomes a problem for longer. Hence, on Friday, the US saw the sharpest steepening of the 5-year and 30-year US Treasury curve since 2009. Short end yields fell sharply, at the same time as long end US yields rose. The 10-2-year US Treasury yield curve also steepened. Ultimately, this stance from the central banks is supportive of risky assets in the short term, but in the long term it makes it harder to being inflation back to the Fed’s 2% target rate. Therefore, we continue to think that within the next 12 months, the Fed’s target level of inflation will be moved higher to 2.5-3%, if this happens then we would expect other major central banks to follow suit.

The Santa rally given a helping hand from the Fed

The impact from central bank comments was a rally for US risky assets. Bitcoin was up more than 2.5% at the end of last week, the S&P 500 was higher by 2.4% and the US dollar was the weakest performer in the G10. European indices did not perform as well; however, they may play catch up at the start of this week. To conclude, if you want to know where global asset prices will go next, follow the US yield curve, which may have made a medium-term low.

Chart 1:

Source: St Louis Federal Reserve