A week in markets: Autumn statements, More Fed speak and a break down in a key correlation for Crypto

The markets have had another week of challenges, although for the most part they have taken them very well. The UK’s Autumn statement painted a bleak picture of the UK’s economic outlook as fiscal consolidation cuts spending and pushes up taxes for middle earners. Added to this, the fallout from the bankruptcy of FTX, the crypto exchange, sent bitcoin into a tailspin, although it has been remarkable stable around the $16,000 level. The US Congress will be split, with the Democrats winning the Senate and the Republicans controlling the House of Representatives. However, the markets focus remains on the Fed, who don’t meet for another month. The impact of the weaker October inflation print is still being felt and is helping to bolster risky assets from other global headwinds. Added to this, a raft of Fed officials has given their indirect approval of a slowdown in the size of rate hikes, with the market now expecting a 50bp rate hike next month to bring US interest rates to 4.25-4.5%.

US stock market: investors in a better mood

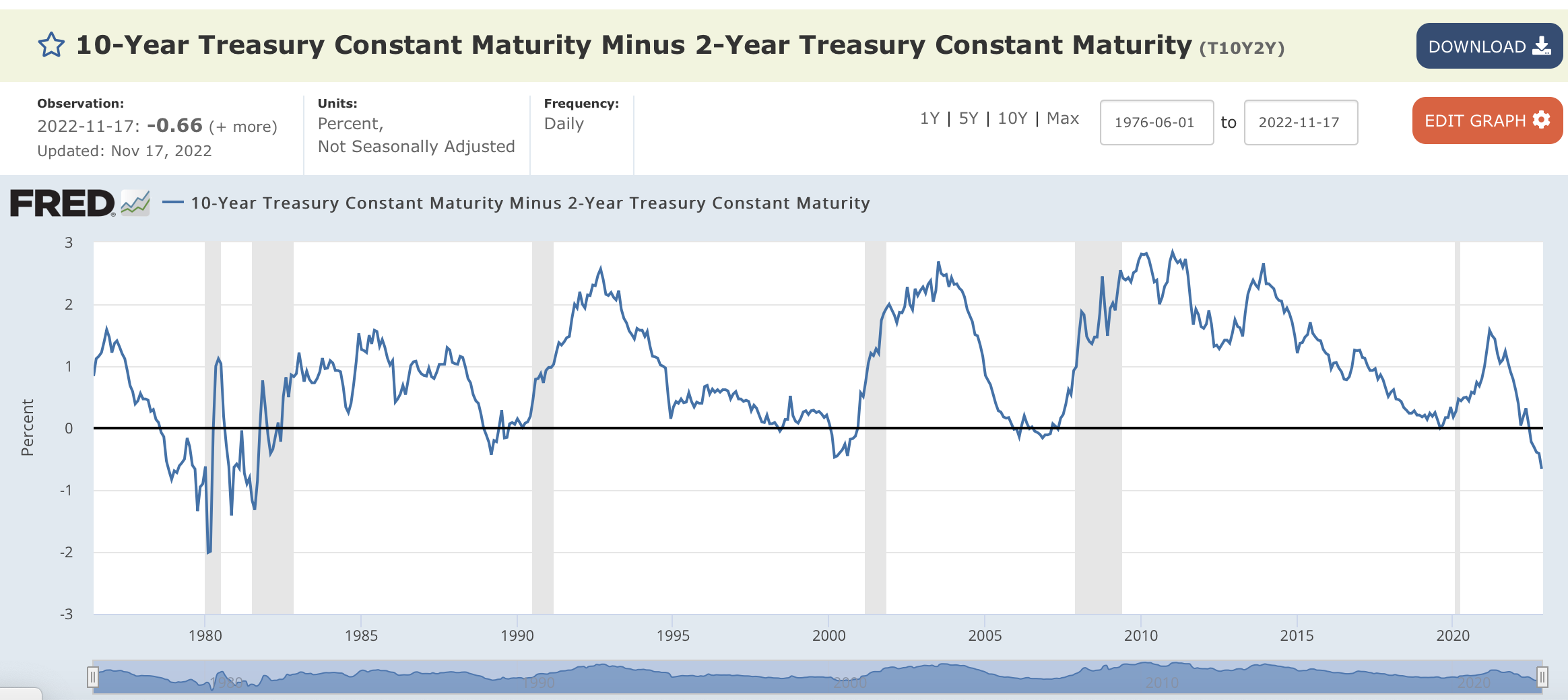

Overall, global indices are higher on Friday, the FTSE 100 is set to close the week slightly higher, while US stocks are set to close lower on the week. This is to be expected after the stunning rally in US stocks last week. The mood music seems brighter as stock traders look to the future. Seasonality is playing its part along with positioning – the market was short stocks and is rebalancing their portfolios now that the Fed pivot looks more likely. Events in China have also bolstered the mood, including China’s zero covid policy tweaks and their property support measures. This doesn’t take away from some of the big risks that remain, including the major inversion of the US yield curve. The 2-10-year yield curve is inverted to the tune of -66 basis points. This matters because the inversion of the yield curve is a recession indicator, and the yield curve is extremely inverted. The last time the inversion was this negative was back in 1981!

Chart 1

Should we fear the inverted yield curve?

Does this mean that the market is really concerned that the recession that is expected in the US will be worse than the 2001 tech bust and the 2008 financial crisis? The answer is no, instead, it is a bad economic sign that should be treated with respect. However, it is worth noting that the yield curve reflects a given set of economic conditions and expectations, thus the yield curve can change based on changes to the economy and to the monetary policy outlook. The market currently thinks that the Fed’s terminal rate will be approx. 5% by next year, thus there could be further rate hikes to come. While the stock market has been cheering the lower rate of inflation, the bond market is typically more cautious. Until we get another month of lower-than-expected inflation, and the Fed states its future intentions at the December meeting, then it’s hard to see the US yield curve changing shape. However, we will be watching the yield curve closely next month and when or if it starts to flatten, then it could give the green light to deeper and more sustained rally for risky assets, although we may have to wait for later in December before that happens.

FX and crypto

The dollar is a touch higher on a broad basis on Friday, however, it remains in a weak technical position. GBP/USD had a malign reaction to the Autumn statement, and is trading just under $1.19, we expect a return to life above $1.20 soon, and the next key resistance level after that psychological milestone is $1.2250, the high from the start of August. EUR/USD has stumbled around the $1.04 level; however, momentum remains to the upside. Another leg lower for the dollar should give life to the euro and other major dollar crosses. The yen has also risen vs. the USD on Friday, after Japanese inflation came in hotter than expected, although we doubt that this will put pressure on the BOJ to hike interest rates anytime soon given their resistance to following the global central banking trend. USDJPY is back below 140, and we don’t expect to see record highs of 150 anytime soon.

Although weakened, the crypto sector has been stable since the sharp route earlier this month on the back of the collapse of FTX. We can’t see a clear path to a recovery for crypto, especially now that the case for regulating the sector is growing and public anger is building at the laissez faire way some crypto businesses protect client funds. Bitcoin/USD is trading around the $16,633 mark at the time of writing, it is hard to see a meaningful recovery back to the $20,000 level any time soon. Added to this, bitcoin and US stocks seem to have broken their correlation. Thus, it is hard to trade crypto right now, both for technical factors and for reputational reasons.

Chart 2: Bitcoin and the S&P 500, a broken correlation