What’s next for Amazon and the future of the cloud?

The financial markets are full of talk about recovering stocks as we move into 2023, and Amazon is a good case study in this environment. It is one of the world’s biggest e-commerce companies, at the same time its fastest growing segment is Amazon Web Services (AWS), which is the largest global provider of cloud services. Not only is Amazon exposed to the consumer sector, but also the corporate sector, in fact some would argue that Amazon’s future growth is more reliant on its corporate customers than its retail client base. However, as we move towards the end of the year, Amazon’s share price has been stubbornly hovering in a tight range between $86 and $100. Below we assess its prospects for 2023, and whether the predictions for AWS’s future growth are on the money.

Assessing the performance of the cloud

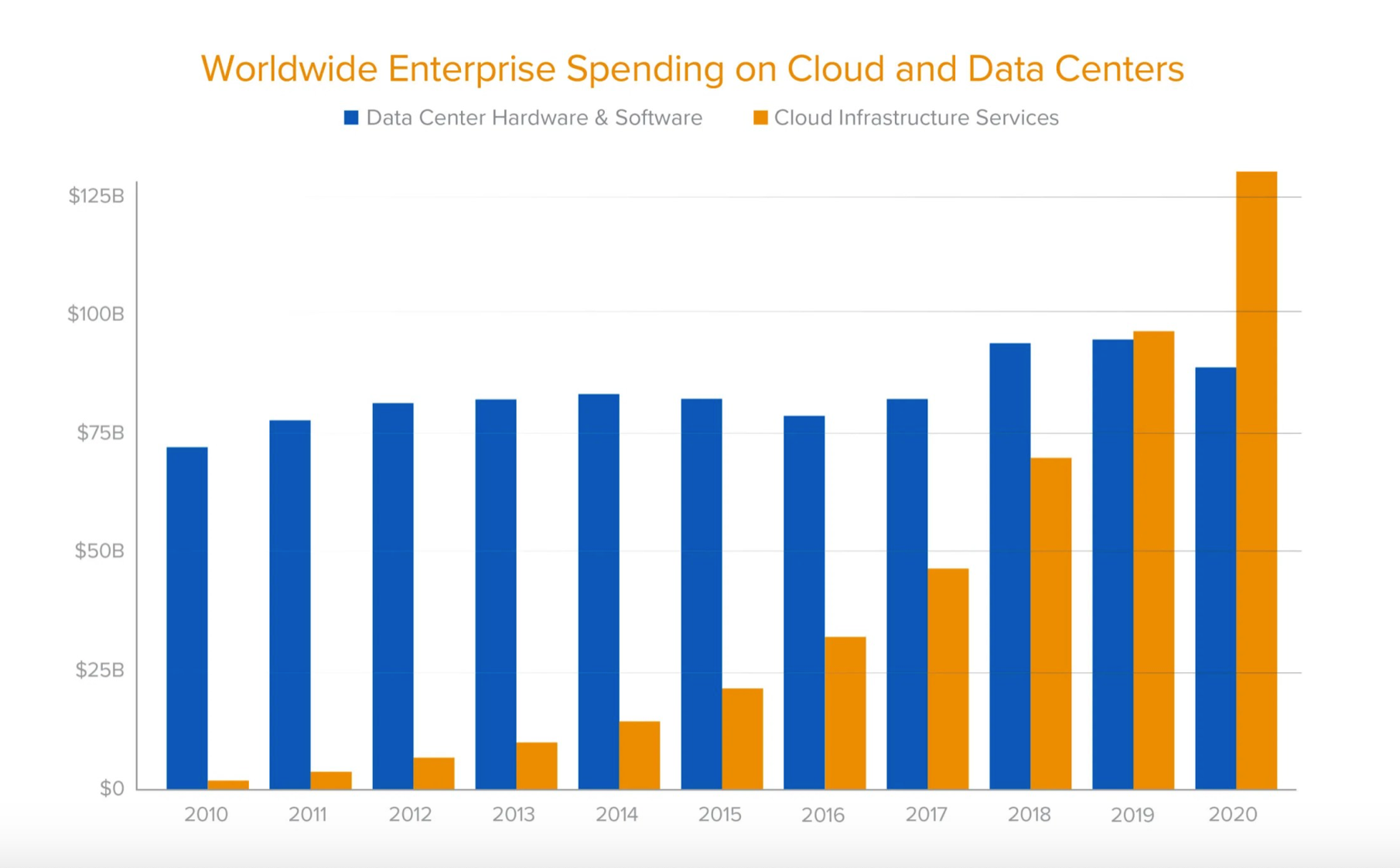

Cloud computing is a key part of the digital universe and AWS is the world’s biggest player. Its main competitors are Microsoft Azure and Google Cloud, AWS has an approx. 34% market share, which is more than Microsoft Azure and Google Cloud combined. AWS has been Amazon’s most important growth driver for most of the last 10 years, however, in 2022 it has hit a bump in the road. In Q3 2022, AWS experienced its slowest period of expansion since 2014. It is worth noting, that it continued to grow at a hefty 25.7%, easily outpacing Amazon’s overall growth rate of 15%, and AWS generated $5.4bn of operating income. Synergy Research Group found that in Q3 global cloud infrastructure spending grew by $57bn, in the last 12 months and spending on cloud infrastructure increased by $217bn. Synergy also believe that a combination of the exchange rate effect and China’s zero covid policy weighed on growth, which otherwise would have been in the mid-30 % mark. However, even with this major obstacle, the growth rate for the overall cloud sector in Q3 was still 25%.

While these numbers are big, it is worth adding some context. When you do this, you realise that there are some ominous signs for AWS. Revenue growth in the last four quarters has fallen from 40% to 25%, a near 40% decline in revenue growth in a year. The question now is whether this decline is due to cyclical or structural factors. Depending on whether you think they are cyclical or structural could influence your view on the outlook for Amazon’s share price in 2023.

The Economy and cloud spending

Everywhere you look there are warning signs about a global recession. From the deeply inverted US yield curve to concerns that the Federal Reserve will have to hike interest rates into a recession, growth concerns are the key problem as we move into 2023. AWS could face three problems in 2023: 1, customers becoming more cost sensitive, 2, a slower pace of migration to the cloud, and 3, lower overall spend by certain sectors, including gaming and finance, as their businesses normalise post the pandemic. Businesses are looking to reduce their cost bases, and cloud spend is one way to do this. Companies are facing pressures in an increasingly volatile environment, and due to this they may forgo embarking on cloud migration altogether, and some may choose to delay or eliminate migrating to the cloud during 2023. Even though we are in a digital age where the cloud and digital infrastructure is of paramount importance to the future of the economy, AWS is not recession proof. Already some large companies have come out and said that their digital budgets are under review or will be cut in the coming months, this includes large AWS customers including Expedia and the National Football League. In Q3, Microsoft also found that the consumption growth of its Azure service moderated, and executives said that it was trying to help clients optimise their spend.

The cloud faces the coming economic storm

AWS has a hefty cash balance; thus, it can afford to help customers to adapt to more stringent financial conditions to keep its client base and AWS is allowing customers to renegotiate their contracts. For example, customers are shifting to lower tier service levels on AWS and there is a shift away from the pay-as-you-go model. This was AWS’s default during its high growth years, it would bill customers based on their consumption each month. This could be expensive, particularly if businesses were running lots of workloads at the same time. Thus, as the economy slows, then so does AWS revenues. However, some moderation in the pace of revenue growth is to be expected as companies over-invested in cloud services during the pandemic, and now a healthy correction is taking place. This surge in demand for AWS and other cloud providers during the pandemic means that AWS is now a much larger business compared to what it was in 2020 -2021, when revenues were boosted by rapid growth rates. A normalisation in revenue growth is thus to be expected.

Chart 1:

Source: Synergy Research Group

The case for AWS

However, even if AWS’s growth rate does moderate, the case for cloud spending and digital services remains compelling. Cloud computing is one of the most significant platforms shifts in the history of computing. International Data Corporation (IDC), the market intelligence provider, predicts that cloud spending will continue to grow more than 12% a year, and revenues could reach $134 bn by 2026. While growth rates may signal a slowdown from the heady heights of growth in 2020 and 2021, it is still impressive in the depths of a global recession. Added to this, the cloud is also a way to facilitate future digital trends including AI and the metaverse, which may also help to drive future revenues. While growth rates may signal a slowdown from the heady heights of growth in 2020 and 2021, however, it is impressive in the depths of a global recession. AWS is also arguing that transitioning to the cloud will help clients to navigate this tough economic period. AWS CEO, Adam Selipsky said that moving IT jobs to the cloud could help customers to save money.

The case against the cloud as money saver

However, there are some who argue that the future of the cloud is not as rosy as these projections expect. It’s become increasingly expensive, and the tough economic climate expected in 2023 could lead to structural change in the IT sector. A report from 2021, entitled “The Cost of Cloud, a trillion-dollar paradox”, produced by Andreesen Horowitz, argues that there is a growing awareness of the long-term cost implications of the cloud, which is forcing firms to re-evaluate migrating their IT infrastructure. They argue that the cloud contributes to the total cost of revenue (COR), which means that as revenues shrink, it is harder to justify the high costs associated with moving workloads to the cloud. Due to this, companies must evaluate the cost of the cloud vs. the cost of running the infrastructure themselves. The Andreesen Horowitz report highlights the magnitude of cloud spending as a percentage of the total cost of revenue. What is more interesting, is that this report was written in 2021, when the cloud was riding a high. However, in these tougher economic climes, when businesses keep a close eye on costs, if cloud gets a reputation for being expensive, or a waste of money, then it could permanently dent sales and damage its reputation. Questioning how expensive the cloud is goes against the prevailing narrative that it is integral to our digital future; however, it could become compelling in this environment.

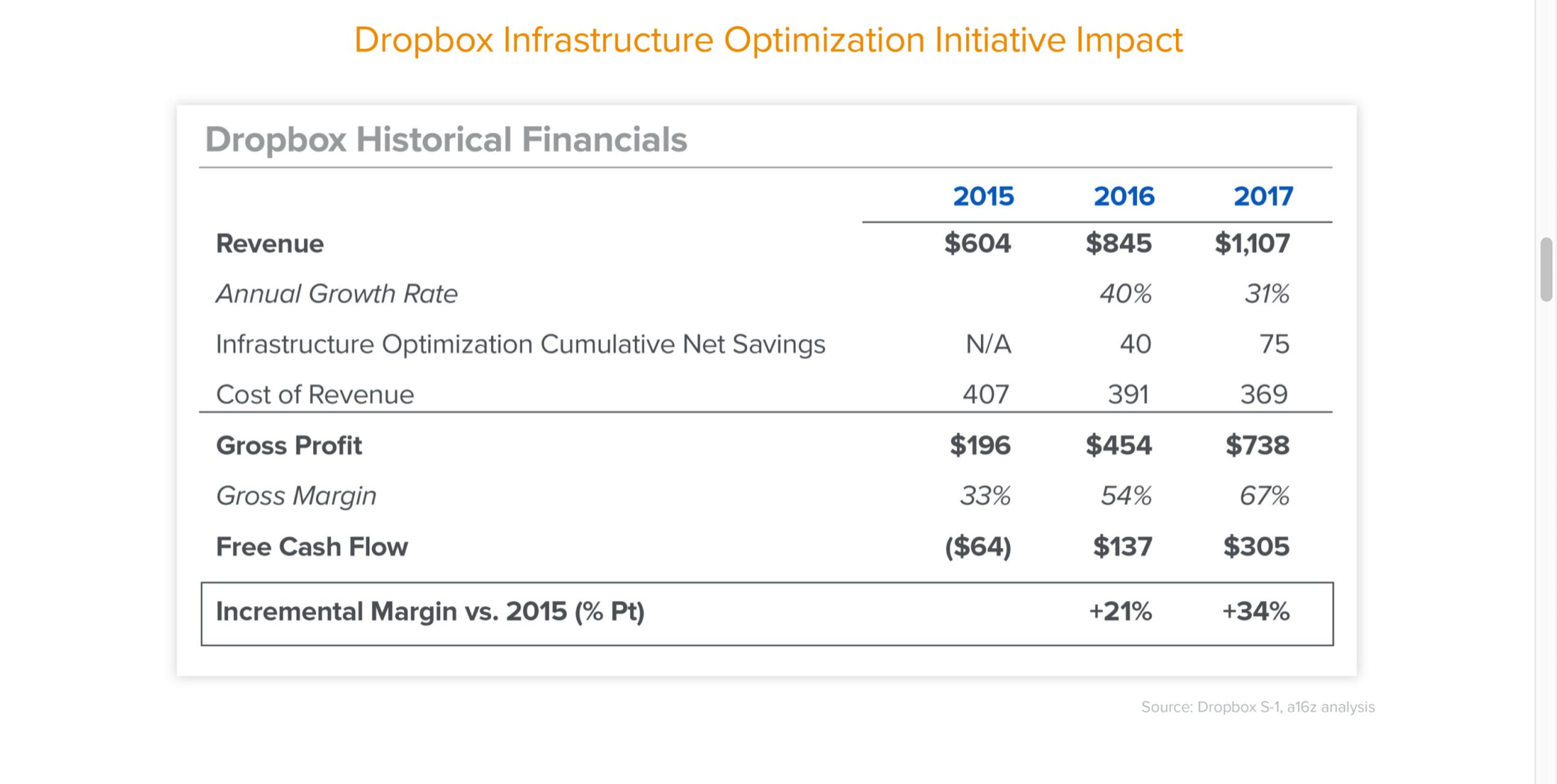

The Andreesen Horowitz report uses Dropbox as an example to highlight the savings that could be made from its infrastructure optimisation initiative in 2016. They saved $75mn in two years by shifting most of their workloads from public cloud to lower cost custom-built infrastructure in co-location facilities. These savings also boosted their gross margins from 33% to 67% between 2015 and 2017. While Dropbox may not be directly relevant for all of AWS clients, it does highlight the cost of cloud, and the huge impact that it can have on your balance sheet.

Chart 2:

Overall, AWS has seen a moderation in its revenues and its EBITDA, however, the consensus is that revenues will grow 25% in 2023, to $100bn. However, if the economy contracts, and inflation remains high, then this figure looks hard to achieve. This makes it hard for us to be too enthusiastic about Amazon shares, even if the share price is stuck in a low range and is close to the lows from 2020. AWS remains challenged in this new economic environment, and until the cycle changes it could be a rough ride for Amazon, even if a move lower in the Amazon share price to $80, a key support level, triggers some buying interest.