Bank of England: hiking rates for now…

The BOE might be leading the pack when it comes to tightening monetary policy, however, after this week’s meeting we think that the mood music has changed at the Bank, and future rate increases could lag behind other central banks, most notably the Federal Reserve.

One member did not vote for the hike, and while inflation risks remain elevated, the BOE sounded concerned about the future growth outlook, and inflation falling back sharply in the longer term. Unlike the Fed, the BOE made no mention of reducing the size of its balance sheet, something it has said that it will consider doing once rates reach 1%, which is only 25 basis points away. The market could scale back the pace of further rate rises on the back of this week’s BOE meeting, which is bad news for the pound, but it could continue to boost the FTSE 100. Overall, May’s BOE meeting will be the next focus for the UK rates market, as the bank will give its updated projections for monetary policy, growth and inflation. Below we look at the main points from this week’s meeting and figure out what this means for UK asset prices.

Main points:

· The BOE voted to raise interest rates for the third time in three meetings to 0.75% this week, which leaves the UK with the highest interest rates out of the major central banks. However, at this week’s meeting, the committee voted 8-1 in favour of a rate hike, with John Cunliffe voting against the rate hike, preferring to keep rates at 0.5% due to the impact of high inflation on household incomes and the negative impact the invasion of Ukraine could have on business and consumer confidence.

· The BOE did not release their monetary policy report at this meeting, they will formally update their forecasts at the next meeting in May, however, the minutes from this week’s meeting said that some further “modest tightening” in monetary policy may be appropriate in the coming months, however, it said that further rate hikes would be data dependent and it would review developments for its May forecasts.

· The BOE said that inflation could rise to 8% in April, 1% higher than the February forecast, due to the recent surge in energy prices. However, the BOE gave an ominous message when it said that inflation rates could surge in October if the energy price cap rises again, this could push price growth “several points higher” than the February forecast indicated. Thus, there is a potential that UK inflation could temporarily spike to double figures later this year.

· The BOE was also concerned about core price inflation, which it said would be further impacted by supply chain disruption caused by the war in Ukraine.

· While wages had risen, consumer confidence had fallen.

· Further out, the BOE still expects inflation to fall back materially and said that there was a risk that it could fall back more than the BOE expected in February.

· The BOE said that inflation would fall back to the 2% target rate, however that view reflects the judgement that monetary policy would act to “ensure that longer term inflation expectations were well anchored around the 2% target”

· GDP for Q1 is expected at 0.75%, however the longer-term outlook for growth was difficult as there wasn’t any evidence yet on the impact of UK growth from the Russian invasion of Ukraine.

· The BOE acknowledged that the market is currently expecting UK interest rates to be 2% by the end of 2022.

Overall, the detail from the BOE was fairly thin, as we need to wait for May’s Monetary Policy Report to get longer term growth and inflation expectations, and the BOE’s plans for monetary policy. However, while the Bank is concerned about inflation, one member is already concerned about the impact of inflation on household incomes. If John Cunliffe can persuade other members to share his view, then the path for monetary policy in the UK could become less hawkish. Interestingly, the 2-year government bond yield has fallen back since the BOE meeting, and is now trading at 1.3%, down from a high of 1.46% on 9thMarch. It is unclear whether short term expectations for UK rate hikes will increase further as the Bank of England may decide to postpone any further tightening of monetary policy to avoid pushing the UK economy into a technical recession later this year. Thus, we believe that GBP upside is limited. GBP/USD is at risk of losing the $1.30 handle, especially after the Federal Reserve was more hawkish than expected on Wednesday, and less worried about the economic impact from the war in Ukraine than the BOE. Added to that, the Fed’s “dot plot” of interest rate expectations, pushed up the median projection for policy rates to 2.8% in both 2023 and 2024, which is higher than the 2.4% projection of the neutral interest rate for the US economy. This suggests that the Fed is expected to tighten monetary conditions beyond the neutral rate, which is dollar positive in the long term. It is worth noting, that the BOE’s rate hiking cycle has not been supportive for the pound in recent weeks, and effective sterling exchange rate had fallen 1.7% since the last MPC meeting, with larger losses registered versus the dollar. We do not think that this meeting will have done anything to change the outlook for GBP in the long term

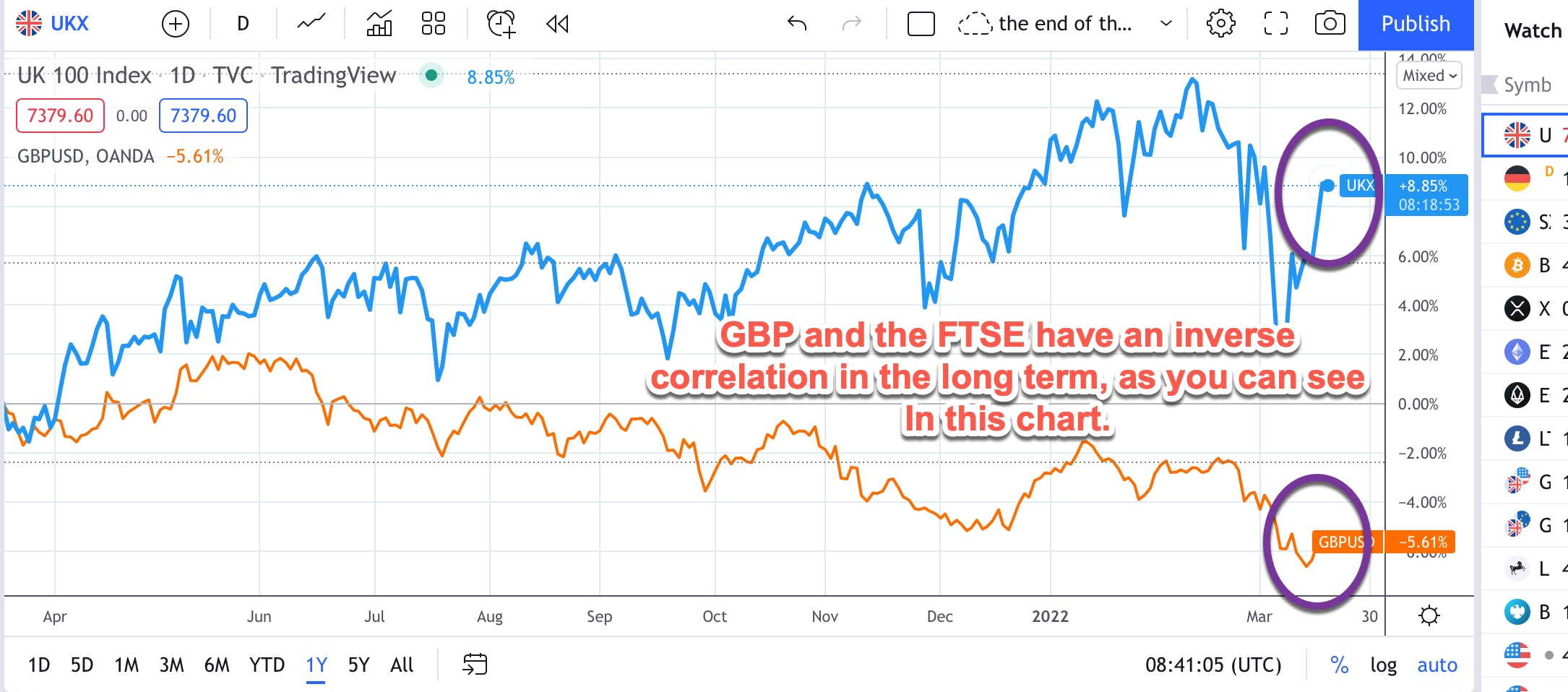

The good news for stock market bulls, is that when the pound falls, we tend to see the FTSE 100 rise. UK stocks were up by more than 1% on Thursday and the FTSE has had a stunning rally since falling below 7,000 on 8th March. We could see more FTSE 100 upside, if the pound continues to weaken. The chart below, highlights this inverse correlation.

Chart 1: