The Fed is in focus as investors hedge their bets

The Fed really is the only game in town this week, after all, the important data releases this week, including US CPI, will be viewed in terms of what it means for Wednesday’s FOMC decision. Will they pause their hiking cycle? The swaps market certainly thinks so. According to the CME Fedwatch tool, the market has a near 74% probability of a pause on Wednesday. However, the language of what the Fed does next has changed in the last few weeks. Instead of people expecting the Fed to “pause” rate hikes at this meeting, it now expects the Fed to “skip” a hike at this meeting. There is an interesting difference between “pause” and “skip”, as the latter is something more temporary than the former. Thus, ahead of the meeting, the market is expecting 75 bps of rate cuts between September and January 2024, however, depending on what the Fed says this week, we could see movement in market-based US interest rate expectations, and when we see movement in the US Fed Funds market, this can cause plenty of volatility across financial markets.

What to watch at the Fed meeting

There are multiple elements to this Fed meeting, which means that us analysts are likely to have a late night on Wednesday parsing what they all mean. However, the chief elements for investors to know about include: the decision, Fed chair Jerome Powell’s press conference, the economic projections for the next two years, and, finally, updated future interest rate expectations, aka the “Dot Plot”. Ultimately, any shift in the dot plot could have repercussions for financial markets. In a crude way, if rate expectations are revised lower then this could be good news for risk sentiment, on the other hand, if rate expectations are revised higher, then this could be negative for risk sentiment.

For reference, the Fed’s current interest rate expectations from their March meeting are: 1-year projections: 4.3%, 2-year projections: 3.1%, longer term projection: 2.5%. March feels like a long time ago, back when the market was scared about the impact of regional US bank failures, since then the economic data has surprised on the upside, however, inflation remains stubbornly strong. Thus, a lot is resting on this week’s FOMC meeting.

Trend inflation shows the Fed is further along in the war of prices than some may think

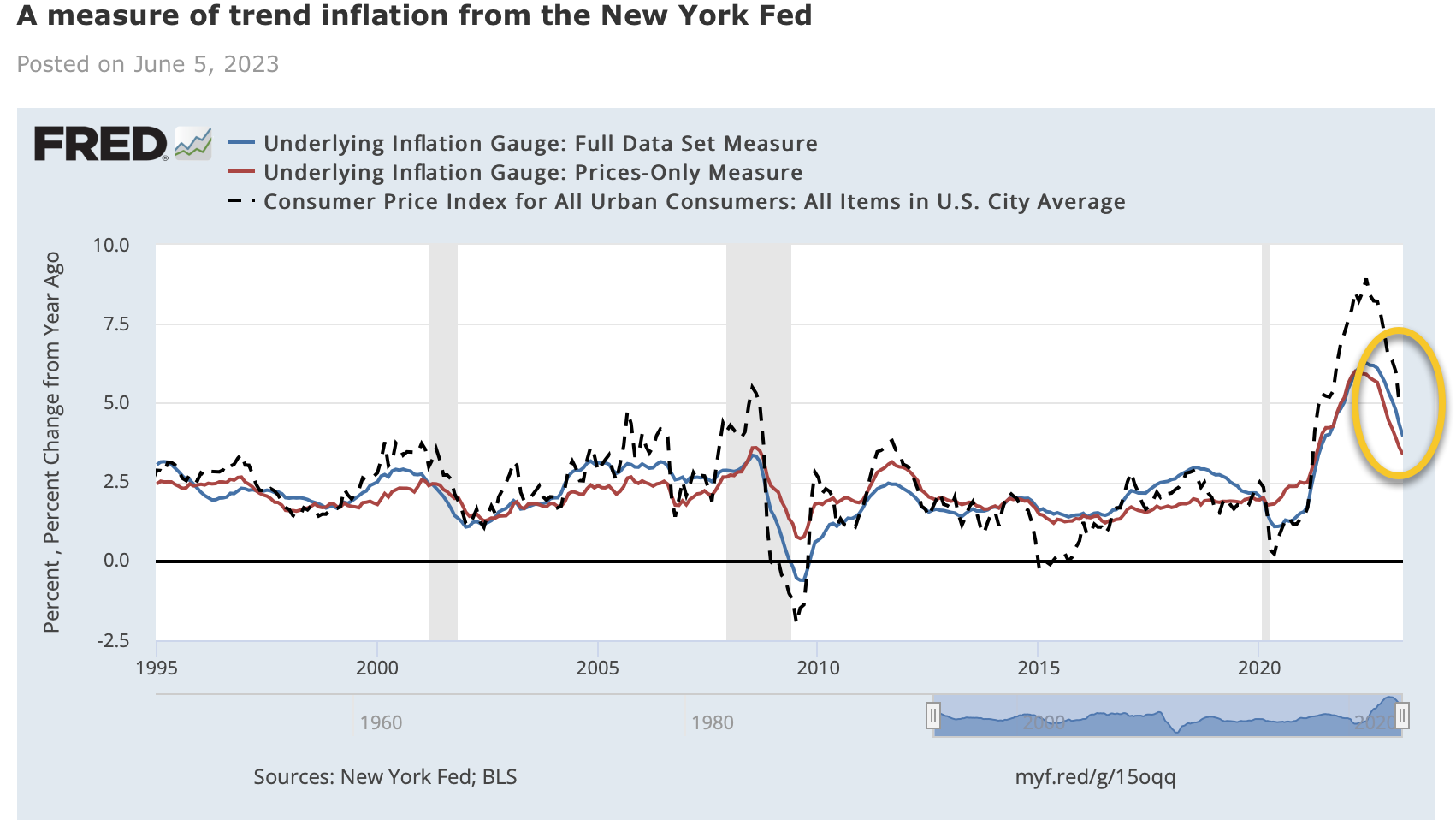

Ahead of the FOMC meeting is the latest US inflation data that will be released on Tuesday. This could lead to some pre-FOMC volatility as the market tries to interpret what it means for the Federal Reserve. The market is expecting the headline rate of inflation to fall to 4.1% from 4.9% in April, while the core rate is expected to drop to 5.3% from 5.5%. Inflation seems like it is on a downward slope, however, it remains well above the Fed’s target rate, which is 2%. Thus, the Fed needs to decide if it will continue to hike rates to stamp out inflation completely, or will it allow the inflation shock to pass on its own? To make that decision it could look at two important indicators aside from the CPI report on Tuesday. The first is the producer price index that will be released on Wednesday at 1330 BST. The market is expecting a 0.1% decline in the monthly index, with the annual index falling to 1.5%. Producer prices are an early input into the inflation pipeline, so when they fall, it tends to weigh on consumer prices with a bit of a lag. Added to this, the Federal Reserve Bank of New York has also found that trend inflation is also lower than the CPI figures suggest. The NY Fed’s Underlying Inflation Gauge (UIG) full data set is currently 3.94%, while the UIG prices only measure is 3.36%, much closer to the Fed’s target rate.

Chart 1: New York Fed Underlying Inflation Gauge

Call options in demand as we lead into the FOMC meeting

Thus, as we head into this week’s FOMC meeting there are reasons for the Fed to be less concerned about inflation, which could be good news for risk sentiment. However, investors are taking a more cautious view. US stocks are up a notch on Monday, however, the S&P 500 has recovered nearly 20% since the October 2022 low, which is considered a bull market. The Nasdaq is up 31% YTD, thus, there is the risk that if the Fed sounds too hawkish on Wednesday it could trigger a sell off for stocks, as mentioned above. However, on balance the data suggests that the Fed will likely take a more cautious approach. This is one reason why the number of call options on the S&P 500 rose to its highest level in 14 months at the end of last week. Since the outcome of this week’s FOMC meeting will dictate equity market performance for the second half of this year, investors could be reducing risk in their physical portfolios, while at the same time buying call options to capture targeted upside. This is a clever strategy leading up to such a pivotal event.

Treasuries: short term bearish, long term hawkish?

However, financial markets are never straight forward, and on the other hand, hedge funds have been increasing their short bets on 2-year Treasury yields (betting that the yield will rise), for 11 straight weeks, which is the longest run-on record. Is this another reason why investors prefer call options now? To complicate the picture even more, hedge fund bearishness towards short term Treasuries, compares with long exposure to US duration, which is at its highest level since 2004. One way to read this is that underlying market sentiment is bullish, yet there are concerns around higher interest rates in the short term. However, if higher rates start to bite, then rates will be cut quickly, hence why investors are happy to have exposure to long dated US Treasuries.

Contrarian indicators and the oil price

Goldman Sachs economists think that risks to forward rates are to the upside, however, many in the market see GS’s view as a decent contrarian indicator, so it could be a signal that the Fed are close to their peak in rates after all. On the topic of contrarian indicators, it is strange that even though Saudi Arabia announced 1mn barrels per day production cuts earlier this month, the oil price continues to tank. Brent crude is down more than 2.8% on Monday, which is weighing on the price of BP and Shell, which are lower by 1.5% and 0.6% respectively.

Overall, the Fed is the only game in town this week, FX pairs are in tight ranges, although GBP/USD has backed away from $1.26, a 1-month high, possibly because of the weakness for some major UK blue-chip stocks. We expect the dollar to broadly remain under pressure if the Fed sounds less hawkish this week.