Bank of England: MPC super hike shows BOE means business when it comes to inflation

The BOE stunned financial markets today when they decided to raise UK interest rates by 0.5%, 0.25% was expected. There is no press conference or updated economic forecasts at this meeting, however, the statement made clear that “the inflation target applies at all times”, regardless of recession threats or surging mortgage rates. The decision was a 7-2 split in favour of the super hike, defying some expectations that there could be a 3-way split, with some of the doves voting for a rate cut. This suggests that the Bank of England is veering to the hawkish side of the fence as inflation threatens to become embedded in the UK economy. Considering the BOE was one of the banks who was expected to follow the Fed and pause rate hikes this month, this larger than expected hike suggests that advanced nations still have work to do when it comes to inflation.

Further rate hikes on the cards

The statement from the Bank also suggests that there could be further rate hikes to come. The statement includes the line: “if there were to be evidence of more persistent pressures (in inflation), then further tightening in monetary policy would be required.” This statement tells us two things: 1, interest rates will only come down once inflation is substantially lower and 2, that wage data and core inflation are the metrics to watch. Thursday’s decision is a clear sign from the Bank of England that they do not want to make a policy mistake in the coming months and that they will not allow inflation to spiral out of control. For those who thought that the BOE was behind the curve when it comes to inflation, today’s 50 bp rate hike will be a welcome sign that the Bank is using its chief policy tool to fight the good fight against rising prices.

Markets react to BOE hawkish “surprise”

As we have mentioned in past notes, there are signs that inflation may have peaked. For example, grocery price inflation has finally started to come down in recent weeks, while producer price growth was negative in May and the Bank of England also pointed out in Thursday’s statement that average weekly earnings are also expected to ease over the rest of this year. Thus, has the BOE hiked by 50 basis points to protect its own credibility, even though it appears that the future path for inflation is lower? The market reaction is hard to gauge at this stage. Initially after the interest rate rise, the 2-year UK Gilt yield fell more than 12 basis points, however, in the 20 minutes or so after the increase the yield has turned higher once again, and it is inching towards 5.9%. Likewise, the pound is also higher on the back of this meeting, suggesting that the FX market is still focussed on interest rate differentials when it comes to GBP pricing, rather than the negative impact interest rate hikes could have on UK economic growth down the line.

BOE moves to the hawkish side of the fence

The BOE is playing a high stakes game. It needs to stamp out inflation, but there are also concerns about surging mortgage payments and the interest on our government debt, especially since government debt levels surged above 100% of GDP last month. If inflation does not fall in the coming months, then this statement makes clear that the BOE will have to continue to raise interest rates. After today’s 50 bp hike, they are a big step closer to the 6% rate, which some analysts believe is the level that the UK economy will fall into recession. Added to this, the make-up of the monetary policy committee will change next month, when uber-dove Silvana Tenreyro will be replaced by Megan Greene, who is more hawkish than her predecessor. Thus, the BOE is likely to move more to the hawkish side of the fence just as the BOE is getting tough on inflation.

How this rate hike could impact financial markets

1, we think that spreads between UK government debt and other western nations will continue to be elevated, which is supportive for the pound for now. However, if this rate hike and the prospect of further hikes causes growth to slip, then we could see the pound turn lower.

2, We don’t see huge rises in UK gilt yields in the short term. Where Gilt yields will go next will be determined by the June wage and labour market data and the inflation report for June, which will be released next month.

3, The FTSE 100 and the FTSE 350 are in the red on Thursday, they are both down more than 1% at the time of writing. The FTSE 350 is more exposed to rising borrowing rates for UK businesses, while the more internationally focused businesses in the FTSE 100 are also at risk from higher interest rates pushing up the pound, and thus weighing on their international revenues. Thus, Thursday’s rate hike is bad news for UK stocks.

4, The mortgage market: today’s rate hike will make mortgages more expensive. As Martin Lewis, the personal finance guru, mentioned on Twitter earlier on Thursday, roughly 1/3 of the population have a mortgage, roughly 1/3 rent and 1/3 own their home outright. Many of those with a mortgage are still on long term fixes. Today’s rate hike hurts renters, due to the spiralling cost of renting in recent years, and those mortgage holders who need to refinance. ML estimates that under 20% of the population will be directly impacted by today’s rate hike, which means that a minority of the population are bearing the bulk of the burden of the recent rate hikes from the BOE. This does not mean that the rate hikes aren’t necessary, inflation is a silent tax on every consumer. However, it highlights how the BOE has an uphill battle to try and rein in inflation, since 1/3 of the population own their homes outright, and these people will have built up savings during the pandemic that they are now happy to spend.

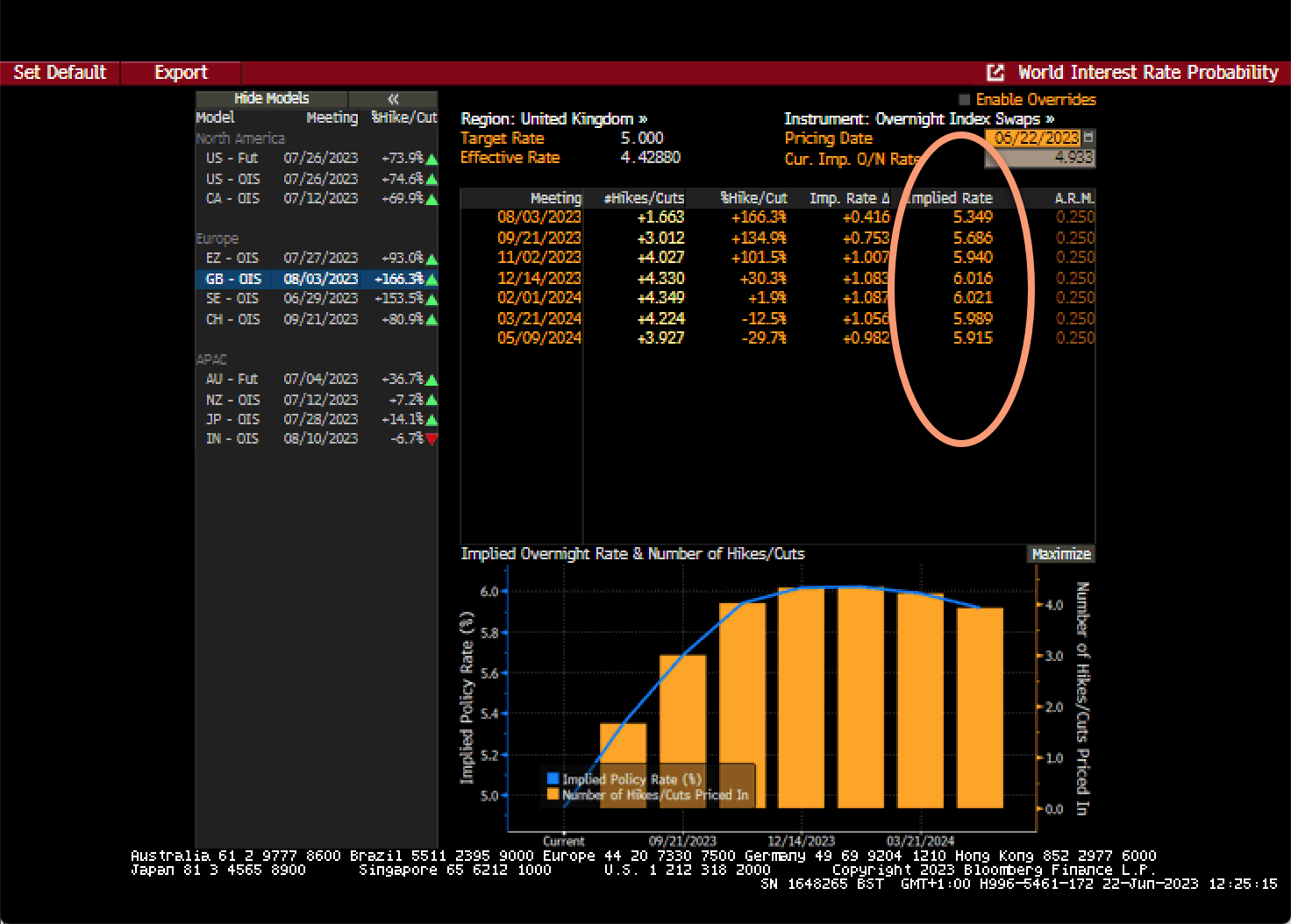

5, Interest rate expectations: interestingly, market-based interest rates are not dramatically different after today’s rate hike from the BOE. Rates are expected to peak at 6.02% in February 2024, with only 11 basis points of cuts expected between February and May next year. Further rate hikes are expected in August, September, and November, with more than 25bp rate hikes expected at each of these meetings. Thus, the market is not ruling out the prospect of further 50bp rate hikes from the BOE. We doubt that rate hike expectations will move dramatically until we get the next set of UK labour market data and inflation data next month.

Chart: Market-based UK interest rate expectations